Washington just owned DC.

Congress came together in a rare show of bipartisanship this week. What brought the opposing sides together? Well, it wasn’t figuring out the debt ceiling or the war in Ukraine, it was voting down Washington, DC’s proposed new criminal code.

The new code had been in the works for over a decade and would have been the first overhaul of the District’s criminal statutes since 1901. Many of the changes were uncontroversial, but federal lawmakers couldn’t get behind the update’s lower maximum penalties for some violent crimes.

Advocates said those changes simply would have brought the code into alignment with the penalties judges actually dispense. But that argument wasn’t persuasive to Republicans — and many Democrats — in Congress, where the proposal was excoriated as being “soft on crime.” DC’s mayor and police chief had also objected to aspects of the update for similar reasons.

Republicans in Congress rag on big-city mayors all the time, but they don’t have the ability to step in and change local laws — except in DC. Though the capital city has had “home rule” since the 1970s, by law, every bill passed by DC’s city council goes to Congress for a review.

Then the president has the final say; they can block Congress from disapproving of District legislation. In the past, President Joe Biden has been a vocal supporter of DC autonomy. But not this time.

“I support DC Statehood and home-rule — but I don’t support some of the changes DC Council put forward over the Mayor’s objections — such as lowering penalties for carjackings,” the President tweeted.

The saga has been a brutal setback for advocates of increased DC autonomy, said Martin Austermuhle, a reporter at WAMU in the District who has for years covered the proposed criminal code update.

“There’s usually a lot of noise from Republicans on the Hill where they dislike things that DC is doing, which is often because this is a Democratic city,” Austermuhle told Today, Explained co-host Sean Rameswaram. ”But for it to get this far and for Democrats and Republicans to be united on this issue against the District is virtually unheard of.”

Below is an excerpt of the conversation between Austermuhle and Rameswaram, edited for length and clarity.

Sean Rameswaram

Can you just remind people how DC’s government works in concert with the federal government?

Martin Austermuhle

Yeah, it’s one of those very confusing things in the sense that nowhere else in the country is like DC. First of all, DC is not a state. And DC only got its own mayor and elected city council back in the mid-1970s. It’s pretty limited home rule. It’s not like, here, govern yourselves and we’ll just step out of the way sort of thing. It’s: Everything that DC does can be checked by Congress.

Essentially, Congress is the ultimate check and balance on the District’s local affairs. So any bill that clears the DC Council goes to Congress, Congress gets a chance to weigh in. Congress has the power to basically tell the district it can’t do certain things by putting provisions in the federal budget that say DC cannot spend money on needle exchange programs. It can’t spend money to legalize the sale of recreational marijuana. It can’t spend money subsidizing abortion for low-income women. And those are all things that Congress has done to DC and is currently doing to DC.

It’s a very kind of fraught relationship because DC did get the chance to govern itself — with adult supervision.

Sean Rameswaram

I think the marijuana example you quickly alluded to there is one of maybe the most illustrative of all of them because I think a lot of people across this country now had the experience of having marijuana legalized for either recreational or medicinal use at the state level, while it’s illegal at the federal level. But in DC, it’s a much murkier situation. Could you explain it to people who aren’t familiar?

Martin Austermuhle

Back in 2014, DC voters approved a ballot initiative that legalized the possession, home cultivation, personal use, and gifting of small amounts of marijuana. So everything but sales.

Sean Rameswaram

Which is to say that if you go into a marijuana dispensary in DC, you don’t buy marijuana. You give them like $20 for a painting or a bracelet and they give you some marijuana along with said painting or bracelet as a gift.

Martin Austermuhle

Yeah, it’s a very confusing, convoluted, and completely congressionally made reality because after DC voters approved this ballot initiative, Congress came back, congressional Republicans came back and said, well, listen, that’s great and good, but you’re not doing anything when it comes to recreational sales. So they put what’s called the budget rider, essentially a prohibition on the city saying you can’t legalize recreational sales. That was in 2015 and it still exists today.

So we have this market where literally dozens of stores across the city, you can pay 50, 60 bucks for a sticker or a cookie and you get your “gift of marijuana.” But like, let’s be honest, we all kind of understand what’s happening: You’re buying marijuana.

Sean Rameswaram

And, of course, there is a very active movement in the District of Columbia to change this status quo.

Martin Austermuhle

It ebbs and flows. There’s times where people say, listen, the ultimate fight is statehood, and that’s what we have to go for. And then there’s moments where they say statehood is never going to happen. Let’s go for something else. Let’s try for, let’s say, like a full voting representative in the House of Representatives because right now it’s just a non-voting delegate. Nothing has moved particularly far.

It was only about eight years ago that the fight for statehood became kind of the main goal, the driving goal for city officials. And it actually got relatively far. I mean, the House of Representatives, when it was controlled by Democrats, voted twice on a bill that would have made DC the 51st state. Now, the Senate has never done the same because of the filibuster, basically. And so the city has been stuck without statehood still.

But it has made progress in making the issue more of a national issue and tying it to voting rights and saying, listen, if you believe in expanding voting access, expanding voting rights, you should also believe in statehood.

Sean Rameswaram

And when Biden came out last week and said he wasn’t going to support this crime bill, he wasn’t going to use his veto, his statement was — and I’m reading here — “I support DC statehood and home rule, but I don’t support some of the changes DC City Council put forward over the mayor’s objections, such as lowering penalties for carjacking,” which a bookstore in DC retweeted, saying, “Look, folks, I fully support the Rebel Alliance, but construction of the Death Star must proceed on schedule.” How complicated is Biden’s support of DC statehood made by his actions in the past week?

Martin Austermuhle

It’s got a lot of people confused because obviously they appreciate that President Biden supports statehood, has said he supports statehood. And last year, he tied the issue of statehood to his broader fight for voting rights, for access to the ballot and that sort of stuff. But now he’s effectively trying to please no one, apparently, by saying I support statehood and I support the district’s right to govern itself, except in this one case where I really don’t support the district’s right to govern itself. And this is why I’m not going to step into this fight that Congress is having with DC. So, yeah, at best it’s confusing. At worst, it’s gotten a lot of people pretty pissed.

Sean Rameswaram

What are the biggest barriers to DC achieving its sort of perpetual goal of being a state?

Martin Austermuhle

I mean, depends who you ask. There’s folks that just say, “It’s a city full of Democrats, which means it’s going to gain two senators that are going to be Democrats, which means it’s going to benefit Democrats in the Senate.” So there’s a very partisan angle to it. There’s also folks who could raise lesser concerns, stuff like DC is just geographically not big enough. And yes, it would be the smallest state by geography, though it would have more people than Vermont or Wyoming. Some Republican senators have raised concerns, including that there’s not enough miners and loggers in DC.

Martin Austermuhle

You know, there are some constitutional concerns where they say the founders wanted a place for the federal government that was insulated from the states, where Marylanders and Virginians couldn’t storm the Capitol. Ironically, you know, when January 6 happened, it was DC police officers that helped clear the Capitol. That’s notwithstanding this idea that DC has to exist in this kind of neutral territory, and so thus DC could never be a state because then it’s no longer neutral, and then the federal government is at the risk of being at the whims of just the District.

Sean Rameswaram

But meanwhile, you’ve got Biden saying he supports statehood. I think Trump at CPAC this year said the federal government should take over management of DC, and you got 700,000 people caught in the middle without much of a right to self-govern.

Martin Austermuhle

I don’t know that anybody could have foreseen this exact series of events happening the way it did. There was always an assumption that, okay, fine, this criminal code bill will go to the Hill. Republicans will vote to disapprove it. But we’ve got the Senate that’s run by Democrats and then that fell. Well, fine. We’ve got Biden. He’s the ultimate backstop. There’s no way that President Biden, a supporter of statehood, wouldn’t veto this. And then President Biden says, no, I’m not going to veto this.

There is some collective anger about the situation the District has always found itself in and continues to find itself in. But there’s also some finger-pointing internally of, was this a strategic mistake by us? Was this just the wrong time to debate criminal justice reform and reforming criminal laws? Shouldn’t we just wait till Democrats at least have maybe retaken the House so we can at least have that as a backstop? So there’s a lot of layers to this. It’s complicated.

Sean Rameswaram

And in the meantime, we have a joke on our license plate.

Martin Austermuhle

“End taxation without representation.” I mean, at least you’ve got that. You’ve got the license plate.

Sean Rameswaram

Yeah. Good. To be fair, I liked it more when it just said “Taxation without representation,” it felt sort of self-deprecating. Now it feels just like this hopeless slogan that’s never going to do anything, but …

Martin Austermuhle

But that being said, the district is rolling out a new license plate this year. It’s going to come out soon. It’s going to say, ”We demand statehood.” So …

Sean Rameswaram

Wow!

Martin Austermuhle

I know, there’s that.

Sean Rameswaram

The joke is over.

Martin Austermuhle

I mean, it’s not … you don’t get a new criminal code, but you get a license plate that says, “We demand statehood.” So there you go.

China’s dealmaking heralds the post-America Middle East.

Welcome to the post-America moment in the Middle East.

US influence has been eroding for decades, from the destructive overreach of the post-9/11 years to the transactional diplomacy of President Donald Trump.

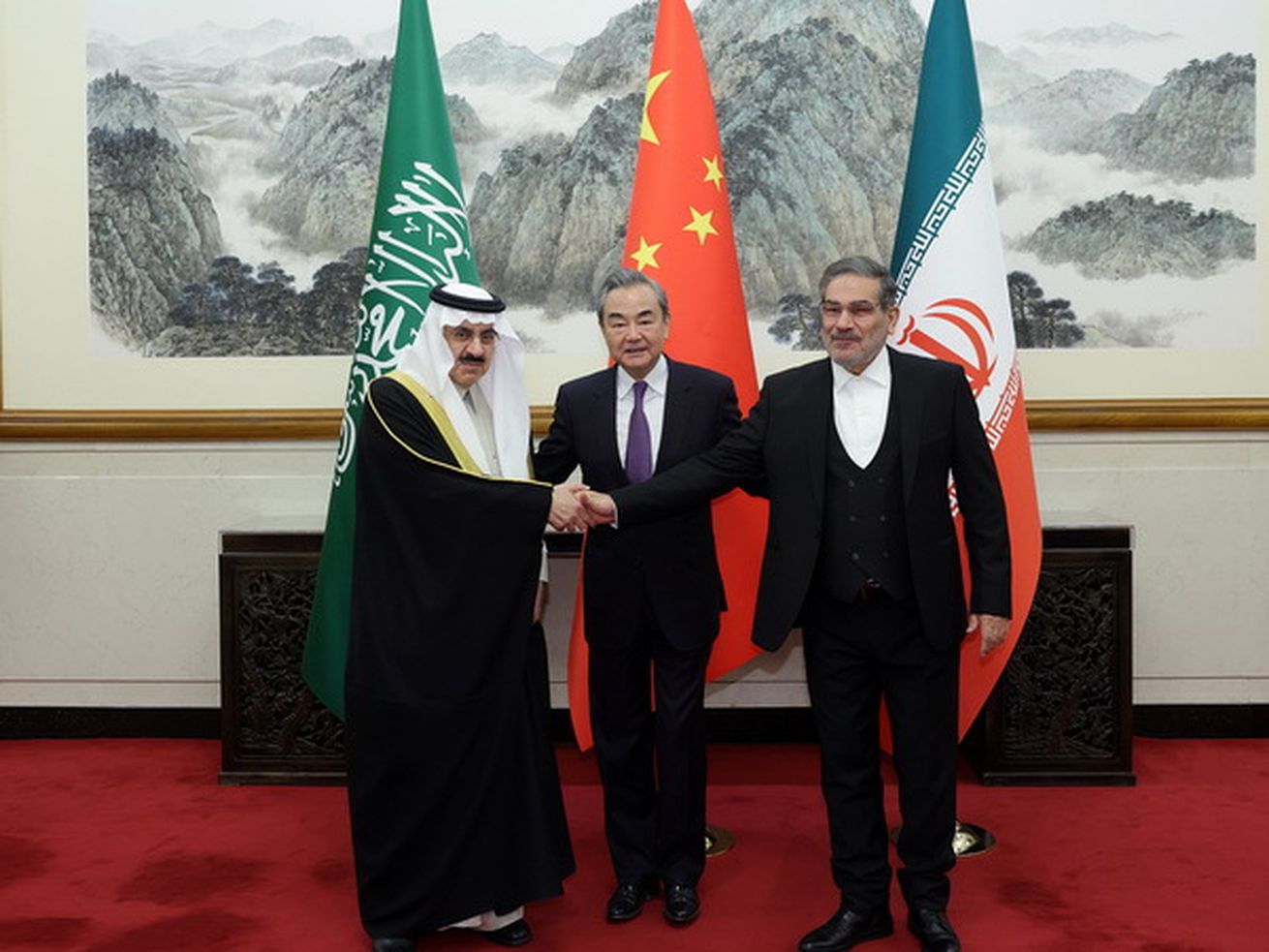

Here we are now officially, with China brokering a detente deal between the Kingdom of Saudi Arabia and Iran.

On Friday, Saudi Arabia and Iran restarted diplomatic relations after seven years of high tensions and violent exchanges between them. Within two months, they will reopen embassies and have both pledged “respect for the sovereignty of states and noninterference in their internal affairs.” The two countries have been engaged in a proxy war in Yemen over the past eight years that has calmed down until recently, and have been on opposite sides of conflicts throughout the Middle East, in Lebanon, Syria, and Iraq. While normalization may not mean a cessation of violence throughout the region, the pause in outright hostilities between the two should be welcomed by all. The breakthrough builds on several years of talks in Iraq and Oman.

And the most interesting dynamic may be that China led the way.

“If you create a diplomatic vacuum, someone’s going to fill it. That’s basically what’s happened to US policy in the Gulf,” says Chas Freeman, a retired career diplomat with extensive experience in the Middle East and China. “It’s a really major development.”

That China played a role shows where global power is shifting — and a meaningful change in how Chinese President Xi Jinping conducts Middle East policy. Thus far, Beijing has been cautious in taking an active role there; this diplomacy, while significant, doesn’t mean China is trying to displace the US security role in the Middle East, Freeman explained. Instead, China is “trying to produce a peaceful, international environment there, in which you can do business,” he told me.

Saudi Arabia, long a US partner, appears to be shaking off its commitment to a unipolar US world. It says a lot about how Saudi Crown Prince Mohammed bin Salman conducts foreign policy as the kingdom brings China and Iran closer, in pursuit of security outside traditional Western allies. “MBS has a preference for an alternative world order that is dominated by the likes of Xi and [Russian President Vladimir] Putin,” says Khalid Al-Jabri, a Saudi entrepreneur and physician. “Take away the grievances between the Saudi and the Iranian regimes, and they are actually more alike than they’re different.”

Did US abdication in the Middle East lead to Chinese diplomatic power?

All diplomacy and normalization is good if it leads to more communication and can calm tensions.

Iran and Saudi Arabia are in opposition across the Middle East, in the tragic proxy war in Yemen, where more than 150,000 people have died, as well as in Lebanon, Syria, and Iraq. The rhetoric has been fiery, with MBS comparing the Iranian leader to Hitler. Since then Iran’s pursuit of nuclear enrichment has led Saudi Arabia to seek a civilian nuclear program. Saudi Arabia has often been on alert for Iranian attacks, and it has led to fears of unintended escalation between the two countries that could set off a broader war.

Saudi Arabia had updated the US on the talks, but Washington was not directly involved. The US does not have diplomatic relations with Iran, and Saudi-Iranian rapprochement was not apparently something the Biden administration was working toward.

Freeman, who served as ambassador to Saudi Arabia from 1989 to 1992, has argued that the Saudi Arabia and Gulf monarchies were already forging a foreign policy independent of the US, in response to what they saw as the abdication of the US military responsibility for the Gulf and diplomatic ineptitude.

After Iran interfered in the key energy shipping pathway around and in the Strait of Hormuz and it or its proxy forces attacked a Saudi Aramco facility in Abqaiq in 2019, the US did not respond with military force. Such US restraint may have been smart in terms of not escalating tensions, but it did leave Saudi Arabia and its partners without a sense of US security backing. “Basically, the US defaulted on a long-standing commitment we had to be the strategic backer and defender of the Gulf Arabs,” Freeman told me.

“The context is one in which a diplomatic default by the US has opened an opportunity for someone else to emerge as a peacemaker,” he says. “The region now speaks for itself. It doesn’t follow anybody’s diktats.”

Iran, hampered by ongoing protests against its government, was perhaps more willing to make a deal. And it’s not yet clear whether the normalization of relations between Iran and Saudi Arabia is a true reconciliation or just a brief cessation of hostilities. Regardless, it’s a promising sign for stability in the region for the short term — less so for US influence in it.

It’s a big blow to the Biden administration’s Middle East policy. After pledging to hold Saudi Arabia to account on the presidential trail, Biden visited the kingdom in an about-face last summer in response to high oil prices caused by Russia’s war — and the US didn’t get very much in return. “They are still pursuing an outdated and disproven cold war mentality by doubling down on their existing allies like Saudi Arabia and abandoning all campaign promises, especially on human rights,” Al-Jabri told me.

Both the Biden and Trump administrations tethered their Saudi and Middle East policy to uniting Israel and Gulf states over countering Iran. Iran and Saudi Arabia’s cooling of tensions shows that for all of the kingdom’s harsh anti-Iranian rhetoric in recent years, there is space for collaboration, albeit without a strong US role.

China is the largest trading partner of the Gulf and most of the Middle East, and it has a real stake in an easing of tensions. Looking ahead, Saudi Arabia made a strategic choice here and elsewhere — it’s looking to join the BRICS grouping of developing countries and take on observer status at the Shanghai Cooperation Organization.

“It indicates that the kingdom wants to focus on domestic economic development over geopolitical conflicts at present, particularly as conflicts in Syria and Yemen settle into stalemate and Iran’s leaders are preoccupied by domestic unrest,” says Andrew Leber, a political scientist focused on Saudi Arabia at Tulane University.

The Iran-Saudi announcement comes as both the Wall Street Journal and the New York Times ran stories teasing the potential of Saudi Arabia and Israel establishing diplomatic ties as part of an expansion of former President Donald Trump’s normalization deals between Israel and Arab states. But analysts I spoke with see little prospect of Israel and Saudi Arabia’s deal of the century. Biden and the US would never agree to Saudi conditions of nuclear power and security guarantees, and Saudi Arabia is unlikely to agree to a real peace deal with Israel.

As for the erosion of US power, the Biden administration politely disagrees. “I would stridently push back on this idea that we’re stepping back in the Middle East — far from it,” White House spokesperson John Kirby said.

Yet for now, there are limits to Biden’s fist-bump diplomacy. The new agreement with some potential to calm the Middle East started not in Washington, but in Beijing.

Tech’s favorite bank just failed. What does that mean for you?

If you work in tech, you had probably heard of Silicon Valley Bank before now. If you’re not familiar with this seemingly regional bank, nobody’s blaming you. It had billions of dollars in deposits, but fewer than two dozen branches, and generally catered to a very specific crowd of startups, venture capitalists, and tech firms. Anyway, you’re here now — Silicon Valley Bank isn’t.

Banking regulators shut down Silicon Valley Bank, or SVB, on Friday after the bank suffered a sudden, swift collapse, marking the second-largest bank failure in US history. Just two days prior, SVB signaled that it was facing a cash crunch. It first tried to raise money by selling shares, then it tried to sell itself, but the whole thing spooked investors, and ultimately, it went under.

The incident has sent shock waves across the tech sector. Many companies and people with money in SVB moved to pull it out earlier in the week — actions that, ironically, contributed to the bank’s demise. But, presumably not everyone was able to get their cash out, and the FDIC only insures deposits up to $250,000, so customers who had more than that in SVB are in a pickle.

Beyond tech, this has caused some shakiness across the banking industry amid concerns that other banks could be in trouble or that contagion could set in. (It’s important to note for consumers here that, really, the money you have in the bank right now is almost definitely fine.) SVB’s blowup is a big deal and a symptom of bigger forces in motion in tech, finance, and the economy.

Still confused about what’s going on? Here are the answers to nine questions you might just have.

- What is SVB, and how big is it?

Silicon Valley Bank was founded in 1983 in Santa Clara, California, and quickly became the bank for the burgeoning tech sector there and the people who financed it (as was its intention). The bank itself claimed to bank for nearly half of all US venture-backed startups as of 2021. It’s also a banking partner for a lot of the venture capital firms that fund those startups. SVB calls itself the “financial partner of the innovation economy.” All that basically means it’s tightly woven into the financial infrastructure of the tech industry, especially startups.

(Disclosure: It’s not just the tech industry that banks with SVB. Vox Media, which owns Vox, also banks with SVB.)

This arrangement has been great for SVB when things were great for the tech industry and not so great when they weren’t. But for a long time now, things have been very, very good, and venture capitalists were giving a lot of money to a lot of startups and going through SVB to do it. SVB had more than $200 billion in assets when it failed, which is far less than, say, JPMorgan Chase’s $3.31 trillion or so. But SVB is the largest bank to fail since the Great Recession, as well as, again, one of the largest US banks to fail ever. —Sara Morrison

- What happened to SVB?

Silicon Valley Bank met its demise largely as the result of a good old-fashioned bank run after signs of trouble began to emerge earlier this week. The bank takes deposits from clients and invests them in generally safe securities, like bonds. As the Federal Reserve has increased interest rates, those bonds have become worth less. That wouldn’t normally be an issue — SVB would just wait for those bonds to mature — but because there’s been a slowdown in venture capital and tech more broadly, deposit inflows slowed, and clients started withdrawing their money.

On Wednesday, March 8, SVB’s parent company, SVB Financial Group, said it would undertake a $2.25 billion share sale after selling $21 billion of securities from its portfolio at a nearly $2 billion loss. The move was meant to shore up its balance sheet. Instead, it spooked markets and clients. The share price of SVB Financial plunged on Thursday. By Friday morning, trading of the stock was halted, and there was reporting SVB was in talks to sell. Big-name VCs such as Peter Thiel and Union Square Ventures reportedly started to tell their companies to pull their money out of the bank while they could.

“People started freaking out, and unfortunately, it would appear rightly so,” said Alexander Yokum, an analyst at CFRA Research who covers banking. By about midday Friday, regulators shut down the bank. —Emily Stewart

- How did this happen so fast?

Part of SVB’s specific problem is that it was so concentrated in its business. SVB catered to venture capital and private equity — as that sector has done well over the past decade, so has SVB. But because the bank was also very concentrated with high exposure to one industry, that opened it up to risk. When things got bad for its non-diversified group of clients, it very quickly got bad for the bank.

“This has proven that having 50 percent plus of your business in one industry is very dangerous. They outperformed on the way up, but on the way down, that’s when you figure out how exposed you are,” Yokum said.

It didn’t help that another bank, Silvergate, which catered to crypto, said it was winding down on Thursday or, again, that once there were signs of trouble at SVB, everybody kind of freaked out. “This is not a slow fall from grace here, this is quick,” Yokum said. They were one of the largest banks in the US, and they went down in a matter of two days. —ES

- What does this mean for the banking system, and just how worried should I be about my bank?

There’s an argument to be made that it’s good for banks to fail from time to time. The longest stretch in US history without a bank failure was from 2004 to 2007, and, well, you know what happened after that. The overall banking industry is likely fine, and again, SVB probably would have made it through had everybody not freaked out at the same time. That said, SVB’s collapse isn’t great, especially for the people who are going to be stuck holding the bag. Bank stocks are sagging, and it’s not impossible that troubles at SVB and Silvergate could prompt issues elsewhere.

“There’s always a risk of contagion, because banking is fundamentally a game of trust and confidence,” said Aaron Klein, a senior economics fellow at the think tank Brookings Institution. “When they erode, the system becomes less stable.”

Yokum, from CFRA, said he wouldn’t be surprised if a couple of other banks run into trouble, but not many — and not the big ones, such as JPMorgan, Wells Fargo, and Bank of America. “It will likely stay concentrated to a few select banks,” he said. “They’re diversified, and they have a ton of deposits. So even if they lose some, they’re still okay. They’re not close to the line of having to sell securities. I really do think it’s banks that cater to high net worth individuals and specialized banks.”

He added there could be more trouble ahead as the Fed continues to increase interest rates in an attempt to cool down the economy and bring down inflation, especially if it does so aggressively. “The more rates go up, the more the banks on the edge start to become a problem,” Yokum said.

Still, you don’t need to start pulling your dollars out of your local bank and hiding them under your mattress. Also, remember up to $250,000 of bank deposits are insured by the federal government, so unless you’ve got more than that in there — which, if you do, congratulations — really, you’re fine. —ES

- What does this mean for tech companies in the near term?

The most immediate issue for tech companies that had money tied up with SVB and haven’t gotten it out yet is a Very Big Question that doesn’t have obvious answers: What happens when I need to pay someone, like my employees?

While the FDIC will guarantee deposits of up to $250,000, depending on the size of the company, that money may not go very far. This doesn’t just apply to companies that deposited cash with SVB — it’s also a question for companies using other SVB instruments, like revolver loans or credit cards. Vox Media, for instance, used SVB cards: This afternoon the company received a message from our chief financial officer, Sean Macnew, telling us that “we are following this closely and working our best to gather information via SVB and other partners.”

There are also real concerns about knock-on effects: Even if your startup doesn’t use SVB, your vendors might, so they may not be able to provide you with services you expect and count on. Even in the optimistic case, where SVB is quickly acquired by another bank and funds start flowing again, the near-term hiccups could be unpleasant for many people. —Peter Kafka

- Why was SVB important to tech companies, and what made them different than other banks?

One way to gauge SVB’s influence in the tech world was to attend a tech conference, where SVB was often a prominent sponsor (and, sometimes, its executives were also featured speakers).

But most of the connections happened behind the scenes: Unlike other banks, tech industry observers say, SVB was willing to work with tech startups in ways other banks might have been more reluctant to, like helping early employees secure personal loans for a house.

More importantly, SVB was particularly flexible about lending tech startups money even though they didn’t have free cash flow (because tech startups usually lose money at the beginning of their lives) or much in the way of assets (because startups often don’t have much more than the brains of their founders and early employees when they launch). “If you are a startup company, you don’t look like a normal business,” says Sean Byrnes, a startup founder and investor who says he has used SVB for years. “Most banks, if you go to them and ask for a loan, they’ll laugh at you.” SVB was also often willing to work with founders who weren’t US citizens, which would be an obstacle for more traditional banks.

The upside for SVB could be meaningful, since in addition to charging interest, the company often received stock warrants that could pay off if the startup got acquired or went public. And when tech was on a tear, the downside was limited: Even failed companies were more likely to pay back SVB’s loans before other investors got their money back, and there would be a steady pipeline of other tech companies lined up to use their services. —PK

- Did SVB collapse so quickly because it was tied to tech?

It certainly seems that way. That’s in large part because the tech startup world is tightly plugged into itself, with founders and executives constantly trading information and boasting on Twitter or text chains or Signal chats. One tech company pulling its money out of a bank is a story that quickly cascades to the leaders of other companies, who then tell leaders of other companies.

“[SVB was] uniquely susceptible given the communication interconnectedness,” says Charlie O’Donnell, a partner at VC firm Brooklyn Bridge Ventures.

And it wasn’t just tech founders talking to themselves: On Thursday, a wave of venture capitalists were explicitly telling their portfolio companies to take their money out of SVB immediately. A startup founder who doesn’t bank with SVB told Vox he got five calls that day from different investors telling him to pull his money.

Looking forward to the tweets from the VCs who sparked this bank run congratulating themselves on their prescience.

— Matt Harris (@mattcharris) March 10, 2023